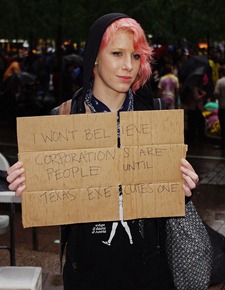

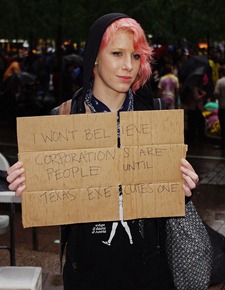

Aa Paul Krugman points out, although disclosure of tax returns is standard practice for political candidates, Mitt Romney has never done so, and, at first, he tried to stonewall the issue even in a presidential race. Then he said that he probably pays only about 15 percent of his income in taxes, and he hinted that he might release his 2011 return. Even then, however, he will face pressure to release previous returns, too — like his father, who released 12 years of returns back when he made his presidential run. (The elder Romney, by the way, paid 37 percent of his income in taxes). And the public has a right to see the back years: By 2011, with the campaign looming, Mr. Romney may have rearranged his portfolio to minimize awkward issues like his accounts in the Cayman Islands or his use of the justly reviled “carried interest” tax break. But the larger question isn’t what Mitt Romney’s tax returns have to say about Mitt Romney; it’s what they have to say about U.S. tax policy. Is there a good reason why the rich should bear a startlingly light tax burden ? For they do. If Mr. Romney is telling the truth about his taxes, he’s actually more or less typical of the very wealthy. Since 1992, the I.R.S. has been releasing income and tax data for the 400 highest-income filers. In 2008, the most recent year available, these filers paid only 18.1 percent of their income in federal income taxes; in 2007, they paid only 16.6 percent. When you bear in mind that the rich pay little either in payroll taxes or in state and local taxes — major burdens on middle-class families — this implies that the top 400 filers faced lower taxes than many ordinary workers. The main reason the rich pay so little is that most of their income takes the form of capital gains, which are taxed at a maximum rate of 15 percent, far below the maximum on wages and salaries. So the question is whether capital gains — three-quarters of which go to the top 1 percent of the income distribution — warrant such special treatment. Defenders of low taxes on the rich mainly make two arguments: that low taxes on capital gains are a time-honored principle, and that they are needed to promote economic growth and job creation. Both claims are false. When you hear about the low, low taxes of people like Mr. Romney, what you need to know is that it wasn’t always thus — and the days when the superrich paid much higher taxes weren’t that long ago. Back in 1986, Ronald Reagan — yes, Ronald Reagan — signed a tax reform equalizing top rates on earned income and capital gains at 28 percent. The rate rose further, to more than 29 percent, during Bill Clinton’s first term.

? For they do. If Mr. Romney is telling the truth about his taxes, he’s actually more or less typical of the very wealthy. Since 1992, the I.R.S. has been releasing income and tax data for the 400 highest-income filers. In 2008, the most recent year available, these filers paid only 18.1 percent of their income in federal income taxes; in 2007, they paid only 16.6 percent. When you bear in mind that the rich pay little either in payroll taxes or in state and local taxes — major burdens on middle-class families — this implies that the top 400 filers faced lower taxes than many ordinary workers. The main reason the rich pay so little is that most of their income takes the form of capital gains, which are taxed at a maximum rate of 15 percent, far below the maximum on wages and salaries. So the question is whether capital gains — three-quarters of which go to the top 1 percent of the income distribution — warrant such special treatment. Defenders of low taxes on the rich mainly make two arguments: that low taxes on capital gains are a time-honored principle, and that they are needed to promote economic growth and job creation. Both claims are false. When you hear about the low, low taxes of people like Mr. Romney, what you need to know is that it wasn’t always thus — and the days when the superrich paid much higher taxes weren’t that long ago. Back in 1986, Ronald Reagan — yes, Ronald Reagan — signed a tax reform equalizing top rates on earned income and capital gains at 28 percent. The rate rose further, to more than 29 percent, during Bill Clinton’s first term.  Low capital gains taxes date only from 1997, when Mr. Clinton struck a deal with Republicans in Congress in which he cut taxes on the rich in return for creation of the Children’s Health Insurance Program. And today’s ultralow rates — the lowest since the days of Herbert Hoover — date only from 2003, when former President George W. Bush rammed both a tax cut on capital gains and a tax cut on dividends through Congress, something he achieved by exploiting the illusion of triumph in Iraq. Correspondingly, the low-tax status of the very rich is also a recent development. During Mr. Clinton’s first term, the top 400 taxpayers paid close to 30 percent of their income in federal taxes, and even after his tax deal they paid substantially more than they have since the 2003 cut. So is it essential that the rich receive such a big tax break? There are theoretical and practical arguments against such special treatment. In particular, the huge gap between taxes on earned income and taxes on unearned income creates a perverse incentive to arrange one’s affairs so as to make income appear in the “right” category. And the economic record certainly doesn’t support the notion that superlow taxes on the superrich are the key to prosperity. During that first Clinton term, when the very rich paid much higher taxes than they do now, the economy added 11.5 million jobs, dwarfing anything achieved even during the good years of the Bush administration. So Mr. Romney’s tax dance is doing us all a service by highlighting the unwise, unjust and expensive favors being showered on the upper-upper class. At a time when all the self-proclaimed serious people are telling us that the poor and the middle class must suffer in the name of fiscal probity, such low taxes on the very rich are indefensible.

Low capital gains taxes date only from 1997, when Mr. Clinton struck a deal with Republicans in Congress in which he cut taxes on the rich in return for creation of the Children’s Health Insurance Program. And today’s ultralow rates — the lowest since the days of Herbert Hoover — date only from 2003, when former President George W. Bush rammed both a tax cut on capital gains and a tax cut on dividends through Congress, something he achieved by exploiting the illusion of triumph in Iraq. Correspondingly, the low-tax status of the very rich is also a recent development. During Mr. Clinton’s first term, the top 400 taxpayers paid close to 30 percent of their income in federal taxes, and even after his tax deal they paid substantially more than they have since the 2003 cut. So is it essential that the rich receive such a big tax break? There are theoretical and practical arguments against such special treatment. In particular, the huge gap between taxes on earned income and taxes on unearned income creates a perverse incentive to arrange one’s affairs so as to make income appear in the “right” category. And the economic record certainly doesn’t support the notion that superlow taxes on the superrich are the key to prosperity. During that first Clinton term, when the very rich paid much higher taxes than they do now, the economy added 11.5 million jobs, dwarfing anything achieved even during the good years of the Bush administration. So Mr. Romney’s tax dance is doing us all a service by highlighting the unwise, unjust and expensive favors being showered on the upper-upper class. At a time when all the self-proclaimed serious people are telling us that the poor and the middle class must suffer in the name of fiscal probity, such low taxes on the very rich are indefensible.

Jackson Pollock, perhaps the most controversial artist of the already controversial 20th century, was born one hundred years ago today on January 28, 1912 in Cody, Wyoming. He was only 44 when he died. He remains a polarizing figure in art and culture, but for all the right reasons. He is derided on each level of society for his drip paintings of the late 1940s and early 1950s. From Joe Six-Pack claiming that his third grade daughter could do just as well, to post-modern scholars deriding the assertion that the arts can contain a singular heroic act, many can meet and agree that Pollock is overrated while sharing no other cultural attitudes. Feminists scold the complex relationship he maintained with his wife, the painter Lee Krasner, and the entire Pop Art and Pop Surrealist movements seem simply to exist to stand in opposition to what Pollock created.

Jackson Pollock, perhaps the most controversial artist of the already controversial 20th century, was born one hundred years ago today on January 28, 1912 in Cody, Wyoming. He was only 44 when he died. He remains a polarizing figure in art and culture, but for all the right reasons. He is derided on each level of society for his drip paintings of the late 1940s and early 1950s. From Joe Six-Pack claiming that his third grade daughter could do just as well, to post-modern scholars deriding the assertion that the arts can contain a singular heroic act, many can meet and agree that Pollock is overrated while sharing no other cultural attitudes. Feminists scold the complex relationship he maintained with his wife, the painter Lee Krasner, and the entire Pop Art and Pop Surrealist movements seem simply to exist to stand in opposition to what Pollock created. It seems almost magical the way a unity emerges from apparent chaos. Check out this video of him painting and this one of him discussing his process. He also has one of the great quotes about art. When asked by a reporter how he knew when he was done with one of his paintings, he replied, “How do you know when you’re done making love?” Happy Birthday, Jackson Pollock! Your work has enriched my life.

It seems almost magical the way a unity emerges from apparent chaos. Check out this video of him painting and this one of him discussing his process. He also has one of the great quotes about art. When asked by a reporter how he knew when he was done with one of his paintings, he replied, “How do you know when you’re done making love?” Happy Birthday, Jackson Pollock! Your work has enriched my life.